The tax deadline is upon us, but if you are seeking tax advice from Capone, you may want to look elsewhere. If you’re filing your return online, or using a tax-preparation service, the pressure is on for last-minute filers trying to get their 2023 forms in on time. Unlike last year, when you had 3 extra days to file your taxes, this year they are due on April 15th. Some years the 15th falls on a Saturday or falls on Emancipation Day so Tax Day gets pushed back a day or two.

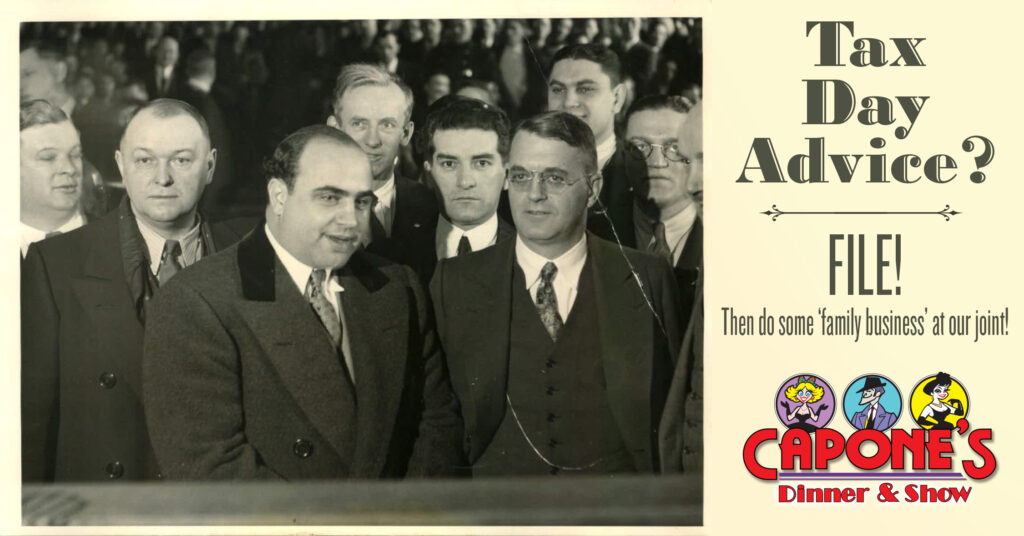

Capone consults attorney, Mike Ahern, in 1929. Ahern, with other Capone attorneys, filed several appeals to stave off Capone’s 11-year sentence for tax evasion. The last one was rejected in May 1932.

We don’t have to tell you the problems taxes presented for Al Capone – but we will. Between 1925 and 1930, Capone controlled speakeasies, bookie joints, gambling houses, brothels, horse and race tracks, nightclubs, distilleries, and breweries at a reported income of $100,000,000 a year. He even acquired a sizable interest in the largest cleaning and dyeing plant chain in Chicago. The popular belief in the 1920s and 30s was that illegal gambling earnings were not taxable income. However, the 1927 Sullivan ruling claimed that illegal profits were in fact, taxable. Capone never filed an income tax return, owned nothing in his name, and never declared any assets or income. He did all his business through frontmen so that he was anonymous when it came to income. The government wanted to indict Capone for income tax evasion and eventually did.

Tax Advice from Capone?

Any tax advice from Capone would not work so well today. Since Al won’t be giving out any advice when it comes to filing taxes, here are some recommendations from the wise guys at the Internal Revenue Service:

- E-file. The IRS said filing online is safer, saves time, and gets your refund to you much faster.

- Double-check your figures. Agents said they see large amounts of number mistakes every year. Be sure to make sure your figures and refund balance are correct. You should also double-check all your identification numbers, especially your Social Security number.

- Don’t forget to sign it. Your signature is required on paper tax forms, and the e-filing process will walk you through submitting an electronic signature.

- If you owe a payment and must write a check, make it payable to the United States Treasury and send it to the correct address. Better yet, create an online account with the IRS and pay directly from your bank account (you know they already know about your accounts).

Forgetting any of these steps could delay the process. If you can’t make the Tax Day deadline, file for an extension that will give you until mid-October. There’s no shame in putting it off, but there could be consequences… just ask Al.

Even though you won’t be getting tax advice from Capone, the wise guys would like to give out one important piece of advice…When you’re all done filing, getting an extension, or evading altogether (we don’t recommend), treat yourself and your gang to a night at Capone’s Dinner & Show! Taxes are hard work and if anyone would sympathize with the pain of filing, it would be Al. Let’s take our minds off it for a night and have a good time! Let ‘the family’ entertain and take care of you!

Last Updated on April 16, 2024